Pros and Cons of Refinancing Your Home

Refinancing your home can be a great way to save money and reduce your monthly mortgage payments. However, it's not always the right choice for everyone. Before you decide to refinance your home, it's important to understand the pros and cons. In this blog post, we'll walk you through everything you

Read MoreEverything You Need to Know About PMI Mortgage Insurance

If you're a first-time homebuyer or a renter planning to buy a home, you likely know that homeownership comes with additional costs beyond the purchase price. One of those costs is Private Mortgage Insurance (PMI). But what is PMI, why is it required, and how does it impact your mortgage payments? I

Read MoreFinding Knoxville's Best Commercial Realtor

For businesses looking to lease or buy commercial real estate in Knoxville, finding the right realtor is crucial. However, with so many options to choose from, it can be overwhelming to determine who is truly the best fit for your needs. In this blog, we will focus on Shawn Wilmoth REALTOR®, a notew

Read MoreKnoxville's Best Realtor: A Guide to Finding the Perfect Agent

Finding the best realtor can be challenging, especially in a competitive market like Knoxville. With countless agents claiming to be the best, it can be difficult to know who to trust. However, you don't have to navigate the real estate market alone. This guide will provide you with all the informat

Read MoreUnderstanding the Basics of Property Appraisal

Buying or renting a property is one of the most significant investments one can make in their lifetime. As a homeowner, seller, or potential buyer, it is essential to make informed decisions. Informed decisions ensure that you invest your money at a fair market value. A property appraisal is a criti

Read MoreLiving in Strawberry Plains, TN

If you are looking for a small, welcoming community to call home, Strawberry Plains TN should be on the top of your list. Located in Jefferson County, East Tennessee, this town has a population of about 2,500 and boasts of a tranquil and refreshing environment. You can enjoy the slow pace of life wi

Read MoreCashing out Equity from your Property: Is it a Smart Idea?

As a homeowner, you might have some equity built up in your property, which is the difference between the current market value of your home and the outstanding balance on your mortgage. Cashing out equity from your property refers to taking out a loan against your home's value or selling a portion o

Read MoreEverything You Need to Know About FHA Loans

When it comes to buying a home, one of the first things you need to consider is financing. There are many different options available, but one of the most popular for first-time homebuyers is an FHA loan. If you're considering an FHA loan, you're in the right place. As an experienced realtor, I've h

Read MoreDeals in Writing: Never Rely on a Verbal Agreement

In today's fast-paced world, people tend to make deals with just a simple handshake or a few words of agreement. However, while verbal agreements are still used in various areas of business, they are becoming more and more unreliable. It can lead to disastrous consequences, especially in those cases

Read MoreFor Sale By Owner Properties: The Pros and Cons You Need To Know

Buying a property is not an easy task. You have to go through a lot of stages and processes before you can finally get your hands on your dream home. One of these stages is choosing whether to buy a property listed by a real estate agent or a For Sale By Owner (FSBO) property. While it might be temp

Read MoreWhy are Commercial Loans Higher than Home Mortgages

There’s no denying that houses can cost a fortune, which is why most people opt to take out a mortgage to finance their dream home. However, for businesses looking to acquire properties or expand their operations, commercial loans are often the go-to financing option. While both options involve borr

Read More-

If you are planning to sell an investment property and use the proceeds to purchase another property while deferring paying taxes on the gain, then a 1031 exchange might be the perfect solution for you. A 1031 exchange is a tax deferment strategy for real estate investors that allows them to swap on

Read More Barndominiums: A Unique and Practical Way of Living

Are you tired of living in the typical house with the same design and layout? Do you crave a unique and practical way of living that provides an comfortable lifestyle, then consider barndominiums. Barndominiums are an excellent concept that combines the essence of barn and living space. It provides

Read More-

If you are planning to buy a home or searching for a property investment, consider buying a duplex. For those unfamiliar, a duplex is a single building that contains two separate living units. And when you buy a duplex, you have the option of living in one unit and renting out the other side. In thi

Read More VA Loans for Multi-Family Units: What you Need to Know

Are you looking to invest in a multi-family unit as a real estate rental property? If so, then you might be interested in VA loans. By utilizing this loan program, you could be potentially making a smart financial decision. They are meant for military service members, veterans, and eligible survivin

Read MoreWhy Should you Choose AirBnB Over Monthly Rentals

Are you a property owner looking for ways to maximize your profits? Maybe you're a renter or a traveler in search of accommodation options that fit your budget. Whether you're on either side of the spectrum, there's been a buzz in recent years about choosing short-term rentals like airBnB over tradi

Read MoreUnderstanding USDA Lending Zones

USDA lending zones play a significant role for those looking to purchase, develop, or refinance property. Understanding what USDA lending zones are and how they function can help home buyers, property owners, renters, and customers make informed decisions about real estate investments. In this compr

Read MoreCommercial Property: What You Need to Know Before Buying or Selling

Whether you're a property owner looking to sell or a buyer searching for the perfect space, navigating the world of commercial real estate can be daunting. The stakes are high, and there are countless factors to consider. From location and zoning regulations to tenant placement and financing, it can

Read MoreWhy Shawn Wilmoth REALTOR® is the Perfect Choice for Your Knoxville, TN Property Needs

Looking for a reliable and knowledgeable Knoxville, TN realtor? You want someone who is experienced and trustworthy. Shawn Wilmoth REALTOR® is the perfect choice for all your property needs. Having years of experience under his belt, he knows the ins and outs of the local market. Helping you find yo

Read MoreThe Real Deal: Exploring the World of Shawn Wilmoth REALTOR®

Are you looking for a reliable realtor who can help you get your dream commercial property in Jefferson City, TN? Look no further because Shawn Wilmoth REALTOR® is here to help you. With his vast experience in the industry, he can provide you with essential insights and guidance that will help you m

Read More

Categories

- All Blogs 1000

- Airbnb Realtor 13

- Barndominium 6

- Buying a home 57

- California Buyers 17

- Commercial Broker 2

- Commercial Property 33

- DR Horton Homes 5

- East Tennessee 59

- Experienced Realtor 40

- Experienced Tennessee Realtor 67

- For-Sale By Owner 24

- FSBO 17

- Gatlinburg 30

- Gatlinburg Cabins for Sale 2

- Gatlinburg Rental Homes for Sale 6

- How to pick a realtor 14

- Industrial Property 9

- Invesment Real Estate Gatlinburg 4

- Investment Property Realtor 27

- Knoxville 66

- Knoxville Jobs 1

- Knoxville Zillow Reviews 1

- Listing your home 30

- Mobile Homes 7

- Modular Homes 9

- Morristown 28

- Mortgage 3

- New build homes 24

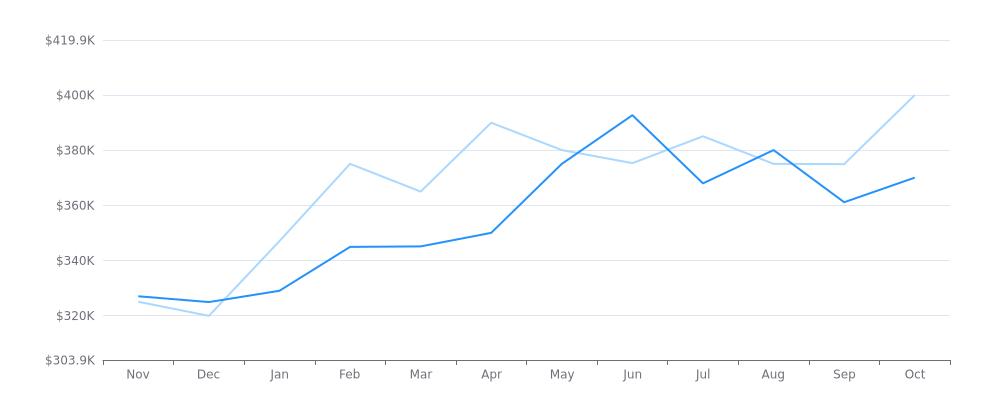

- Price of Homes in Knoxville 10

- Realtor Blog Feed 3

- Reccomended Tennessee Realtor 48

- Refinancing 2

- Rental Property 7

- Retail Building sites 4

- Retail Land for Sale 3

- Selling a home 19

- Short-Term Rentals 2

- Smithbuilt Homes 2

- Strawberry Plains 1

- Tennessee 39

- Tennessee Lenders 3

- tract homes 1

- Vacant Commercial Land 4

- Warehouse for Sale 1

- Zillow Agent 1

Recent Posts